Loading

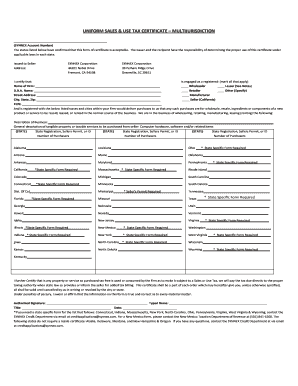

Get Synnex Uniform Sales & Use Tax Certificate - Multijurisdiction 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Synnex Uniform Sales & Use Tax Certificate - Multijurisdiction online

Filling out the Synnex Uniform Sales & Use Tax Certificate - Multijurisdiction online is essential for businesses to comply with tax requirements. This guide will walk you through the necessary steps to accurately complete the form, ensuring you can make tax-exempt purchases for the states you operate in.

Follow the steps to successfully fill out your tax certificate.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the 'Synnex Account Number' section and enter your unique account number for accurate identification.

- In the 'Issued to Seller' section, provide the seller's name and address. Verify that the details align with the supplier or entity from whom you will be purchasing.

- Indicate your business type by checking all applicable boxes: wholesaler, retailer, manufacturer, or other. Also, fill in the 'Name of Firm' and 'D.B.A. Name' fields.

- Complete your address details by filling in the 'Street Address', 'City, State, and Zip' fields accurately to ensure proper record-keeping.

- Input your Federal Employer Identification Number (FEIN) in the designated field to comply with federal regulations.

- Describe your business activities briefly, mentioning that the purchases are intended for wholesale, resale, or components for new products and services.

- List the states where your business is registered by filling in the 'State Registration, Sellers Permit, or ID' fields for each state applicable.

- Sign and date the certificate in the 'Authorized Signature' area. Ensure the typed name and title are accurate and reflect your designation within the business.

- Once completed, save changes, download, print, or share the form as necessary. Ensure all required copies are distributed to the appropriate parties.

Complete your documents online today and ensure compliance with tax regulations.

Related links form

Contact the Tennessee Department of Revenue at 1-800-342-1003 or online at www.tn.gov/revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.