Loading

Get Proposed Collection; Comment Request For Form 8823

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Proposed Collection; Comment Request For Form 8823 online

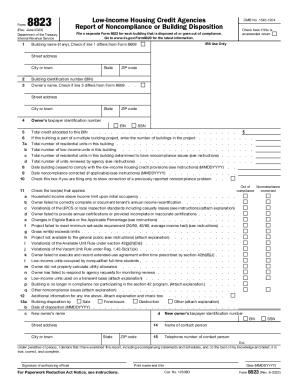

Filling out the Proposed Collection; Comment Request For Form 8823 online is an important task for housing credit agencies to report any building disposals or noncompliance with low-income housing tax credit provisions. This guide provides clear and supportive steps to help you navigate through each section of the form.

Follow the steps to complete Form 8823 accurately.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Complete Section 1 by providing the building name, street address, city, state, and ZIP code accurately for the property in question.

- Enter the Building Identification Number (BIN) as assigned by the housing credit agency in Line 2.

- In Line 3, input the owner's name and ensure that if it differs from Form 8609, you check the appropriate box.

- Provide the owner's taxpayer identification number in Line 4, and ensure that it matches the number reported in previous documents.

- Fill in Line 5 with the total credit allocated to the BIN specified earlier.

- Include information about the building project in Lines 7a and 7b, detailing the number of buildings and total residential units.

- Complete Line 8 with the date the building ceased compliance (MMDDYYYY format) and continue with Line 9 if applicable.

- Address any noncompliance issues in Lines 11a through 11p, checking boxes that apply and providing necessary explanations where indicated.

- If applicable, indicate if the filing is to show a correction of a previously reported noncompliance in Line 10.

- Fill out Lines 12 through 15 with the contact person's information, including name, title, and phone number.

- Review all sections for accuracy and completeness before finalizing the form.

- Once satisfied, save your changes and choose to download, print, or share the completed form accordingly.

Complete your Form 8823 online today to ensure compliance with tax regulations.

Related links form

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.