Loading

Get Gst159

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst159 online

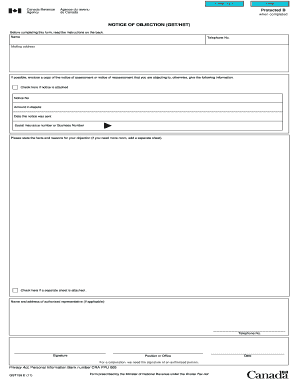

Filling out the Gst159 form can be a straightforward process once you understand each section and its requirements. This guide will provide you with step-by-step instructions to help you complete the notice of objection efficiently.

Follow the steps to complete your Gst159 form online.

- Press the ‘Get Form’ button to access the document and open it in your chosen online editor.

- Begin filling in your personal information in the designated fields, including your name, telephone number, and mailing address.

- If available, attach a copy of the notice of assessment or notice of reassessment you are disputing. Indicate whether the notice is attached by checking the appropriate box.

- Provide additional information such as the notice number, the amount in dispute, and the date the notice was sent.

- Enter your Social Insurance Number or Business Number in the specified field.

- Describe the facts and reasons for your objection in the provided space. If you require more room, check the box indicating that a separate sheet is attached.

- If applicable, enter the name and address of your authorized representative, along with their telephone number.

- Sign the form, ensuring your position or office is noted if it's submitted on behalf of a corporation.

- Date the form appropriately and review all entries for accuracy.

- Once completed, save changes, download, print, or share the form as needed.

Complete your Gst159 and other documents online today to ensure timely processing and submission.

Download GST Certificate – Steps Under the 'Services' Tab, select 'User Services' and then select 'View/Download Certificate' from the drop down.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.