Loading

Get Us Dept Of Agriculture Ccc 926 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Us Dept Of Agriculture Ccc 926 Form online

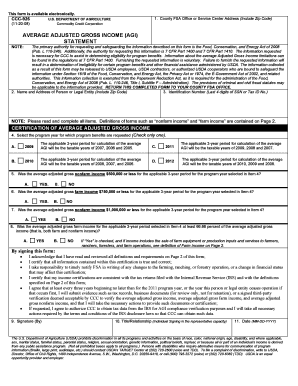

The CCC 926 form is essential for individuals and entities seeking program benefits from the U.S. Department of Agriculture. This guide provides a clear step-by-step process to help users accurately fill out the form online.

Follow the steps to complete the CCC 926 form effectively.

- Click ‘Get Form’ button to obtain the CCC 926 form and open it in the editor.

- Enter the county FSA office or service center address, including the zip code, in section 1.

- Provide the name and address of the person or legal entity requesting the benefits in section 2, ensuring to include the zip code.

- Select the appropriate program year for which benefits are requested in section 4 by checking only one box.

- Answer the questions in sections 5 to 8 regarding the average adjusted gross incomes for the applicable 3-year period, by checking either 'Yes' or 'No.'

- Read the certification statement and acknowledge it by signing in section 9, including the date in section 11.

- If signing on behalf of an entity, fill in the title or relationship in section 10.

- Review all entries for accuracy before finalizing your form submission. You can save changes, download, print, or share the completed form as needed.

Complete your CCC 926 form online effortlessly and ensure timely access to USDA program benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The 941 form is used to report income taxes withheld from employee paychecks, along with the employer's portion of Social Security and Medicare taxes. This form is essential for meeting payroll tax obligations. Ensuring accurate filings with the 941 form can also streamline compliance with other agricultural forms such as the Us Dept Of Agriculture Ccc 926 Form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.