Loading

Get Ca W2/1095-c Request Form 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA W2/1095-C Request Form online

Filling out the CA W2/1095-C Request Form online is a straightforward process that allows users to request their tax documents efficiently. This guide will walk you through each section and field of the form, ensuring that you can complete it accurately and with ease.

Follow the steps to fill out the CA W2/1095-C Request Form online

- Press the ‘Get Form’ button to access the CA W2/1095-C Request Form and open it for editing.

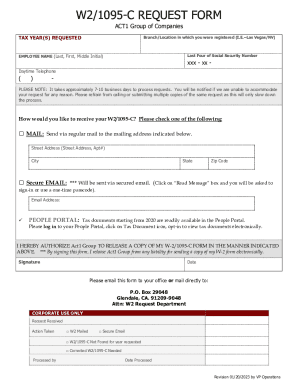

- In the 'Tax Year(s) Requested' field, indicate the specific tax year for which you are requesting the W2/1095-C forms.

- Provide the location or branch where you were registered, for example, 'Las Vegas/NV'.

- Enter the last four digits of your Social Security number to verify your identity.

- Fill in your full name in the 'Employee Name' field, listing your last name, first name, and middle initial.

- Provide your daytime telephone number in the designated field, ensuring it's accurate for any necessary communication.

- Select your preferred method of receiving the W2/1095-C by checking the appropriate box for either regular mail or secure email.

- If you prefer to receive your documents by mail, fill in your mailing address, including street address, city, state, and zip code.

- If you opt for secure email, enter your email address in the specified field and ensure it is correctly typed.

- Review the section regarding the People Portal to understand that tax documents starting from 2020 can be accessed there.

- Authorize the release of your W2/1095-C form by signing and dating the form at the designated area.

- Once completed, email this form to your office or mail it to the provided address: P.O. Box 29048, Glendale, CA 91209-9048, Attn: W2 Request Department.

- Remember, it may take approximately 7-10 business days to process your request.

Complete your CA W2/1095-C Request Form online today for efficient processing.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.