Loading

Get Idaho St 133 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho St 133 Fillable Form online

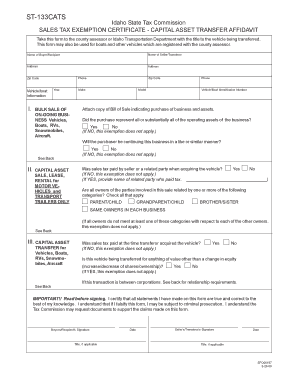

The Idaho St 133 Fillable Form is essential for claiming sales tax exemptions related to the transfer of vehicles, boats, and other capital assets in Idaho. This guide will help you complete the form online with clear instructions tailored for users of all experience levels.

Follow the steps to complete the Idaho St 133 Fillable Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in the buyer/recipient's information, including their name, address, phone number, and zip code. Ensure that all details are accurate as this will be vital for processing.

- Provide the seller/transferor's information, mirroring the previous step in terms of accuracy.

- In the vehicle/boat information section, enter the year, make, model, and vehicle/boat identification number. Ensure that this data matches the title.

- Determine whether the sale is a bulk sale of an ongoing business by checking 'Yes' or 'No'. If 'No,' the exemption does not apply.

- Address whether the purchaser will continue the business by checking 'Yes' or 'No'. This must be assessed as it influences the exemption eligibility.

- Proceed to the capital asset sale section, indicating if sales tax was previously paid by the seller or related parties. Provide any necessary details as prompted.

- In the relationship categories, select applicable familial connections among the owners involved in the transaction.

- Complete the capital asset transfer section by confirming if sales tax was paid at the time the transferor acquired the vehicle. Specify if the vehicle is being exchanged for value beyond a change in equity. Again, check 'Yes' or 'No' as required.

- Sign and date the form at the bottom, ensuring both the buyer's and seller's signatures are present for validation.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your Idaho St 133 Fillable Form online now to ensure a smooth transaction.

The most common type of deed used in Texas is a general warranty deed. This type of deed guarantees the title comes without any liens, easements, or other title problems. A general warranty deed also assures the buyer that there will be no issues with the title.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.