Loading

Get Ny Mmbb A01m 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY MMBB A01M online

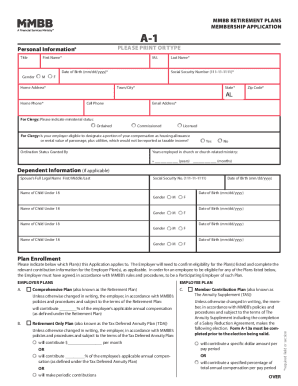

Filling out the NY MMBB A01M form is an essential step for individuals seeking membership in the retirement plans offered by the Ministers and Missionaries Benefit Board. This guide provides a detailed, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to complete the NY MMBB A01M form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. Fill in your title, first name, middle initial, last name, and date of birth in the required formats.

- Provide your home address, completing all components such as town or city, state, and zip code. Your social security number is essential and should be entered in the prescribed format.

- Fill in your contact information, including home phone, cell phone, and email address. Ensure all details are accurate for communication purposes.

- If you are a clergy member, indicate your ministerial status by selecting the appropriate option. Answer whether your employer can designate a portion of your compensation as non-taxable.

- Provide the number of years you have been employed in church or church-related ministry.

- If applicable, provide details about dependents, including spouse and children under 18. Include full names, social security numbers, genders, and dates of birth.

- Select which plans you are applying for by indicating the Comprehensive Plan, Retirement Only Plan, and Member Contribution Plan. Fill in the relevant contribution details if applicable.

- Complete the employment information section by providing details about the church or organization you are affiliated with, along with billing contact information.

- The employer should fill in compensation information, including annual cash salary and housing allowance. Ensure all figures are rounded to the nearest dollar.

- Review and accept the agreement statement regarding eligibility, payment, and updates of information. Make sure all signatures are obtained where required.

- Finally, save changes, download the completed form, or print it for submission. Ensure the form is sent to the address provided.

Complete your documents online today for a seamless application process.

Related links form

Control and Ownership of Separate Property The signature of both spouses is required to convey Texas homestead, even if the property used as the marital home is actually owned by only one spouse.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.