Loading

Get Canada Gst489 E 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST489 E online

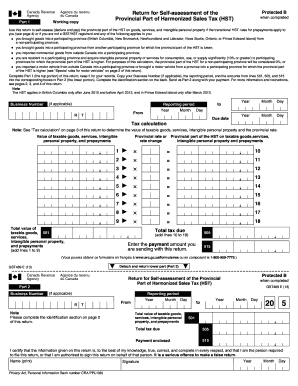

The Canada GST489 E form is used for self-assessing the provincial part of the Harmonized Sales Tax (HST) for certain transactions. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring compliance and accuracy in your reporting.

Follow the steps to effectively fill out the Canada GST489 E online.

- Click 'Get Form' button to obtain the form and open it in an appropriate editor.

- Complete Part 1 of the form, filling in all required fields, including your Business Number (if applicable), the reporting period, and the due date.

- Provide the total value of taxable goods, services, intangible personal property, and prepayments in the corresponding fields. Ensure to add lines 1 to 9 to obtain the total value for line 501.

- Determine the provincial rate applicable to your transactions and enter it in the specified section. Calculate the provincial part of the HST on your taxable goods and enter the results in lines 10 to 18.

- Add the totals from lines 10 to 18 to find the total tax due on line 505.

- Proceed to Part 2 of the form. Copy your Business Number, reporting period, and amounts from lines 501, 505, and 515 into the corresponding boxes.

- Complete the identification section on the back of Part 2, including your legal name, trading name, mailing address, and contact information.

- Sign Part 2 to certify that the information is accurate and complete, and ensure it is sent along with your payment.

Complete your document submissions online to ensure timely and accurate assessments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form RC158, Remittance Voucher Payment on Filing Use Form RC158 to send a payment along with a return. Form RC158 will show the tax year-end. You have to enter the amount you are paying in the "Amount paid" box.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.