Loading

Get Irs 656 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656 online

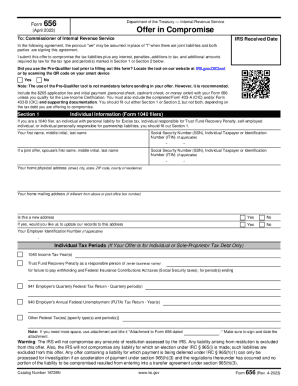

The IRS Form 656 is a critical document for individuals or businesses seeking to settle tax liabilities through an offer in compromise. This guide will provide you with a clear and structured approach to filling out the IRS 656 online.

Follow the steps to complete your IRS 656 offer in compromise.

- Press the ‘Get Form’ button to access the necessary form and open it in an editing interface.

- Complete the required information in the sections designated for either individual or business tax debt. Ensure you are filling out Section 1 for individuals or Section 2 for businesses.

- Provide your personal details in Section 1, including your name, Social Security Number, and address. If applicable, also fill in your partner’s details if it is a joint offer.

- Specify the tax periods and types of taxes you are including in your offer. If needed, attach a separate document titled ‘Attachment to Form 656’ to provide additional details.

- Indicate if you qualify for Low-Income Certification in Section 1. If you do, ensure you check the appropriate box and omit any application fee or payments.

- In Section 3, clearly state the reason for your offer by selecting the relevant option and providing any necessary explanations or documentation.

- Select your preferred payment terms in Section 4, choosing whether you will make a lump sum payment or periodic payments. Fill in the necessary amounts according to your chosen method.

- Designate how you want your payments to be applied in Section 5, indicating the specific tax years and debts, if necessary.

- In Section 6, outline the source of funds for your payment, ensuring you include all required documentation.

- Review and ensure all sections are completed accurately before signing in Section 8. Confirm that all signatures are gathered and that the document is dated.

- Once all fields are completed, save your changes. You may also opt to download, print, or share the form as needed.

Now that you know the stages of filling out the IRS 656 online, start preparing your documents for submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, after 10 years, the IRS forgives tax debt. After this time period, the tax debt is considered "uncollectible". However, it is important to note that there are certain circumstances, such as bankruptcy or certain collection activities, which may extend the statute of limitations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.