Loading

Get Al Sr2 Instructions 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL SR2 Instructions online

This guide provides a step-by-step approach to filling out the AL SR2 Instructions online. It is designed to assist users, regardless of their legal experience, in completing the necessary form accurately and efficiently.

Follow the steps to complete the AL SR2 Instructions online.

- Click the ‘Get Form’ button to obtain the AL SR2 Instructions and open it in the editor.

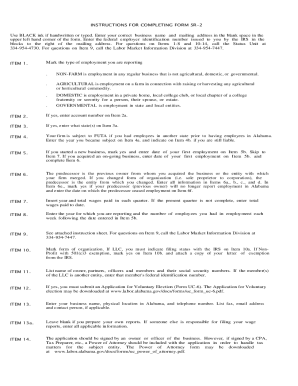

- In the upper left-hand corner of the form, enter your correct business name and mailing address using black ink if filling out the form by hand.

- Next, input your federal employer identification number issued by the IRS in the designated blocks to the right of your mailing address.

- For Item 1, mark the type of employment you are reporting: non-farm, agricultural, domestic, or governmental.

- Complete Item 2 by entering the account number if applicable.

- In Item 3, indicate the state(s) if applicable.

- For Item 4, provide the year you became subject to FUTA in Item 4a and indicate your current liability status in Item 4b.

- For Item 5, if you started a new business, mark 'yes' and enter the date of your first employment in Item 5b. If you acquired an ongoing business, enter the same date and move to Item 6.

- In Item 6, provide all relevant predecessor information as requested and indicate in Item 6e if your predecessor will cease reporting employment in Alabama.

- Enter the total wages paid in each quarter in Item 7. If the current quarter is ongoing, enter total wages paid to date.

- for Item 8, write the year you are reporting along with the number of employees you had employed each week after the date entered in Item 5b.

- Refer to attached instructions for Item 9 and reach out to the Labor Market Information Division if necessary.

- Mark your form of organization in Item 10, providing any additional IRS filing status in Item 10a and attaching necessary documents for NonProfit status if applicable.

- In Item 11, list the names and social security numbers of owners, partners, and members, ensuring to include their federal identification numbers if applicable.

- For Item 12, be aware that submitting an Application for Voluntary Election (Form UC-6) is necessary if applicable. This form can be downloaded from the state tax website.

- In Item 13, provide your business name, physical location in Alabama, and contact details as required.

- Complete Item 13a if reports are prepared by someone other than yourself, otherwise leave it blank.

- Finally, remember that Item 14 needs to be signed by an owner or officer of your business. If someone else is signing, include a Power of Attorney.

- Once you have filled out all sections, save your changes, and you can then download, print, or share the form as needed.

Start completing your AL SR2 Instructions online today.

PROCESSING TIME FOR YOUR CLAIM It usually takes two or three (2-3) weeks following the week you filed your claim to receive your first benefit payment, provided that you have followed all instructions, filed your weekly certifications as instructed, and have met all eligibility requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.