Get Iht216 Word Document Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht216 Word Document Form online

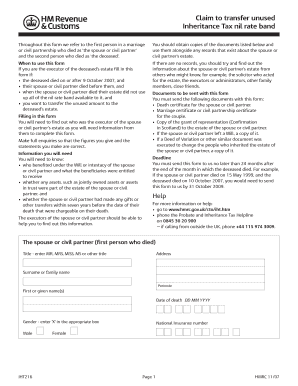

Filling out the Iht216 Word Document Form can be essential for transferring the unused Inheritance Tax nil rate band from a deceased spouse or civil partner's estate. This guide provides clear and supportive instructions for users, regardless of their legal experience.

Follow the steps to successfully complete the Iht216 form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin the form by entering the details of the spouse or civil partner who passed away first. Fill out their title, address, surname, first name(s), date of death, gender, and National Insurance number in the appropriate fields.

- Next, provide the information regarding the deceased partner. Complete the title, date of death, surname, first name(s), gender, and National Insurance number.

- For the spouse or civil partner's estate, indicate whether a grant of representation was obtained. Enter the net value of the estate declared for Probate and the IHT nil rate band in force at the time of their death.

- Continue to fill in the total of any lifetime transfers or gifts made within seven years before the date of death and calculate the available nil rate band against the estate.

- List any legacies and assets passing under the Will or intestacy and provide the share of jointly owned assets, along with any assets held in trust.

- Identify any gifts that might have reservations and complete the chargeable estate details to determine the nil rate band available for transfer.

- If applicable, document any exemptions or relief taken into account for the values you provided.

- Complete the declaration section, ensuring all necessary representatives sign and date the form.

- Once you have accurately filled out the form, save your changes, download it for your records, print a copy if needed, and prepare to share it alongside the IHT200 form to the Inheritance Tax office.

Begin filling out the Iht216 Word Document Form online today to manage your inheritance tax effectively.

Related links form

You are not required to claim the transferable nil rate band, but doing so can be financially beneficial. If you choose not to claim it, you may miss out on significant tax savings. To claim the transferable nil rate band, you’ll need to complete the Iht216 Word Document Form. Our platform can guide you through this process, ensuring you don’t miss out on any potential savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.