Loading

Get Irs Form 8940 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8940 online

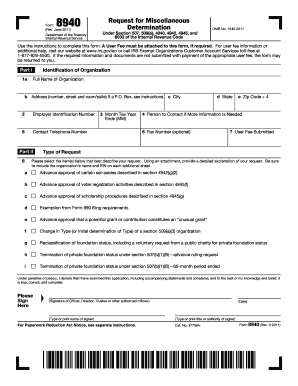

Filling out IRS Form 8940 is essential for organizations seeking a miscellaneous determination. This guide provides clear and supportive instructions on how to complete the form online, ensuring that users understand each section and can accurately submit their requests.

Follow the steps to complete your IRS Form 8940

- Click ‘Get Form’ button to obtain the form and open it for completion.

- In Part I, provide the identification information of your organization. Fill in the full name, address, city, state, and zip code. Ensure all details are accurate, as this information is vital for processing your request.

- Enter the Employer Identification Number (EIN) in the designated field. This number uniquely identifies your organization and is essential for IRS records.

- Provide a contact telephone number and, if desired, a fax number for any follow-up communication. This helps the IRS reach you in case of questions regarding your submission.

- Indicate the month your tax year ends by filling in the appropriate month in MM format. This information helps classify your organization’s tax-filing schedule.

- Select the type of request you are making from the options provided. You may need to add an attachment with a detailed explanation of your submission, ensuring your organization's name and EIN are included.

- After completing the form, review all entries for accuracy. Once verified, provide the signature of an authorized official, type or print their name, and indicate their title or authority. It is crucial to declare under penalties of perjury that the information is true and complete.

- Finally, save your completed document. You can download and print it for your records or share it as required. If applicable, ensure you include any necessary user fee when submitting the form.

Start completing your IRS Form 8940 online today for a seamless submission experience.

For 2020, the User Fee for Form 8940 is $400 until June 30. It will increase to $500 on July 1. Note that the IRS might not generate an acknowledgement letter for the applicant when it receives a Form 8940, Request for Miscellaneous Determination. The IRS requires a separate User Fee for each type of Form 8940 request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.