Loading

Get 4868 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4868 Form online

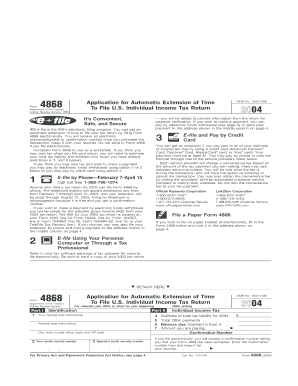

Filling out Form 4868 provides you an automatic extension of time to file your U.S. Individual Income Tax Return. This guide will walk you through the process of completing the form online, making it easier for you to manage your tax obligations.

Follow the steps to complete the 4868 Form online:

- Use the ‘Get Form’ button to access the electronic version of Form 4868 and open it in a suitable editor.

- In Part I, provide your identification details. Enter your name(s), address, and social security number. If filing jointly, include both parties' names and social security numbers.

- In Part II, enter your estimated total tax liability for the year on line 4. Make sure to enter this amount accurately based on available information.

- On line 5, indicate the total payments already made for the tax year, which helps determine your balance due.

- Calculate the balance due by subtracting line 5 from line 4 and enter the result on line 6. If your total payments exceed your estimated liability, enter -0-.

- On line 7, indicate the amount you are paying, if applicable. This should be as much as you can afford to minimize interest owed.

- After completing the form, review all information for accuracy. You can now save changes, download, print, or share the form as needed.

Complete your tax extension documents online to ensure timely filing.

Luckily, the IRS allows taxpayers to request an extension. So, what is the tax extension time period? Once you've requested the extension, you automatically have an additional six months beyond the original filing deadline.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.