Loading

Get S Corp Shareholder Basis Worksheet Excel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the S Corp Shareholder Basis Worksheet Excel online

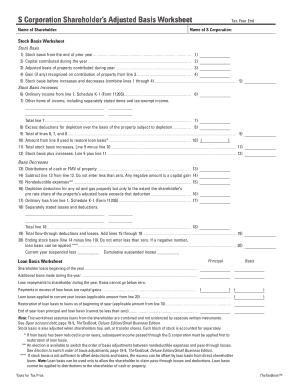

The S Corp Shareholder Basis Worksheet Excel is a crucial tool for S corporation shareholders to track their stock and loan basis. This guide will provide you with clear, step-by-step instructions on how to accurately fill out this important worksheet online.

Follow the steps to complete the worksheet accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the shareholder in the designated field at the top of the worksheet. This identifies the individual whose basis you are calculating.

- Next, input the tax year end date in the appropriate field. This indicates the fiscal period for which you are reporting the shareholder's basis.

- Fill in the name of the S corporation in the specified area. This is crucial for linking the worksheet to the correct corporation.

- Complete the Stock Basis section by starting with line 1, where you will enter the stock basis from the end of the prior year.

- For line 2, input the total capital contributed during the year. This includes any additional investments made by the shareholder.

- On line 3, provide the adjusted basis of any property contributed during the year. This is important for determining the overall basis.

- Continue to line 4, where you will report any gain recognized on the contribution of property from line 3, if applicable.

- Line 5 requires you to sum the amounts from lines 1 through 4 to find the stock basis before increases and decreases.

- In the Stock Basis Increases section, complete line 6 by entering the ordinary income as indicated on line 1 of Schedule K-1 (Form 1120S).

- Line 7 involves noting any other items of income, which includes separately stated items and tax-exempt income. Summarize this information as needed.

- For line 8, report any excess deductions for depletion over the basis of the property subject to depletion.

- Add together the values from lines 6, 7, and 8 to calculate the total on line 9.

- If applicable, complete line 10 to indicate any amounts from line 9 used to restore loan basis.

- On line 11, subtract line 10 from line 9 to determine the total stock basis increases.

- To update the stock basis, add line 5 and line 11 together on line 12.

- In the Basis Decreases section, enter any distributions of cash or fair market value of property on line 13.

- Line 14 requires you to subtract line 13 from line 12, ensuring the result is not less than zero.

- On line 15, denote any nondeductible expenses that have occurred.

- For line 16, report any depletion deductions for oil and gas property, ensuring it does not exceed the adjusted basis.

- Line 17 requires you to indicate any ordinary loss from line 1 of Schedule K-1 (Form 1120S).

- Complete line 18 with separately stated losses and deductions.

- Add the totals from lines 15 through 18 on line 19 for total flow-through deductions and losses.

- Finally, calculate the ending stock basis on line 20 by subtracting line 19 from line 14, ensuring the final figure is not negative.

- Review all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Start completing your S Corp Shareholder Basis Worksheet online today for accurate record-keeping.

It may be beneficial for shareholders to complete and retain Form 7203 even for years it is not required to be filed, as this will ensure their bases are consistently maintained year after year. and the excess business loss limitations (Form 461).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.