Loading

Get Mdes 1d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mdes 1d online

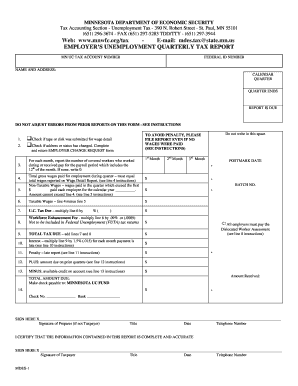

This guide provides step-by-step instructions on how to accurately complete the Mdes 1d form for employer unemployment tax reporting. Designed for users of all experience levels, this document will help you navigate through each section of the form with ease.

Follow the steps to successfully complete your Mdes 1d form.

- Click ‘Get Form’ button to access the Mdes 1d document and open it in the online editor.

- Enter your MN UC tax account number and federal ID number at the designated fields at the top of the form.

- Provide your name and address clearly in the specified section, ensuring all details are up to date.

- Fill in the calendar quarter and the quarter ending date to indicate the reporting period.

- Note when the report is due and ensure timely submission to avoid penalties.

- Indicate if a tape or disk was submitted for wage detail by checking the respective box.

- If there have been changes to your address or tax status, complete and return the Employer Change Request form.

- Report the number of covered workers for the payroll period that includes the 12th of the month for each month in the quarter. If none, enter 0.

- Enter the total gross wages paid for employment during the quarter, ensuring this amount matches the total on your Wage Detail Report.

- Input non-taxable wages, which are wages exceeding the specified amount for the calendar year. Ensure this does not exceed the amount on line 4.

- Calculate taxable wages by subtracting non-taxable wages (line 5) from gross wages (line 4).

- Determine U.C. tax due by multiplying taxable wages (line 6) by the applicable tax rate.

- Fill in the Workforce Enhancement Fee based on taxable wages (line 6).

- Add the amounts from lines 7 and 8 to find the total tax due.

- Calculate any interest due for late payment and any penalties as specified in the instructions.

- Subtract any available credits from prior quarters as indicated.

- Sign the form in the designated spaces, including the signature of both the taxpayer and preparer if applicable.

- Once all fields are completed, review your entries for accuracy before saving, downloading, printing, or sharing the completed form.

Complete your Mdes 1d form online today for efficient tax reporting.

Minnesota's new employer tax rates range from 1.1% to 9%, including the 0.1% base tax rate and also vary by industry. Minnesota's Unemployment Insurance Program provides a 2023 table that includes an industry overview. The one constant for all employers is that the wage base is $40,000 for each employee, in 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.