Loading

Get Fbt Calculation Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fbt Calculation Sheet online

Filling out the Fbt Calculation Sheet online is an essential process for accurately calculating fringe benefits tax for employers. This guide will walk you through each step of the form to ensure that you complete it correctly and efficiently.

Follow the steps to complete the Fbt Calculation Sheet seamlessly.

- Click ‘Get Form’ button to access the Fbt Calculation Sheet and open it in your preferred online editor.

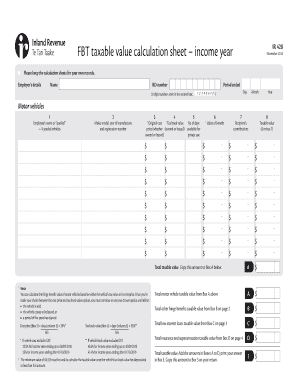

- Enter your employer's details, including your name, IRD number, and the period ended. Ensure the date is noted in the required format: day, month, and year.

- In the motor vehicles section, provide the employee's name or indicate 'pooled' if applicable. Fill in the make, model, year of manufacture, and registration number of the vehicle.

- For Box 3, enter the original cost price of the vehicle. Alternatively, fill in the tax book value in Box 4, depending on your choice of calculation method.

- Indicate the number of days the vehicle was available for private use in Box 5.

- Calculate the value of the benefit using the formulas provided based on your selected calculation method and enter the results in Box 6.

- List any recipient's contributions in Box 7. Subtract this amount from the value in Box 6 to calculate the taxable value, which will be entered in Box 8.

- Ensure to complete the total taxable value calculations across all sections of the form. Copy the amounts from the various boxes (A, B, C, D) into the designated areas to finalize the total taxable value.

- Review all entries for accuracy, then save your changes. You can download, print, or share the completed Fbt Calculation Sheet as needed.

Start filling out your Fbt Calculation Sheet online today for accurate tax reporting.

What Are Fringe Benefits Examples. Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.