Loading

Get Fl Fpl Form 6037a 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL FPL Form 6037A online

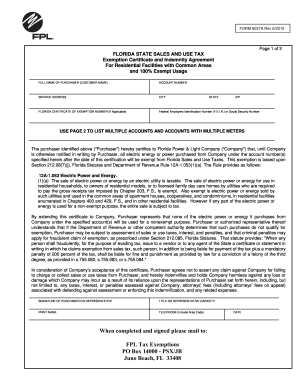

Filling out the FL FPL Form 6037A online is a straightforward process that allows users to certify their exemption from Florida Sales and Use Taxes for electric power usage in residential facilities. This guide provides clear and supportive instructions to help you complete the form effectively.

Follow the steps to fill out the FL FPL Form 6037A online

- Click the ‘Get Form’ button to obtain the FL FPL Form 6037A and open it in your browser. This will provide you access to the document in an editable format.

- Begin by filling in the full name of the purchaser in the designated field. This should reflect the name of the individual or entity claiming the exemption.

- Enter the account number associated with the electric service. This number can typically be found on your utility bill.

- Provide the service address where the electricity is utilized. Ensure that this address is accurate to avoid any issues with your exemption status.

- Input the city and state corresponding to the service address. This section often requires a two-letter state abbreviation (FL for Florida).

- If applicable, enter your Florida Certificate of Exemption number. This number is crucial for verification purposes.

- Fill in the Federal Employers Identification Number (F.E.I.N.) or Social Security Number as required. This information is used for identification and tax reporting.

- Review the information to ensure accuracy and completeness. Double-check all fields before proceeding.

- Sign the form in the designated area to certify the accuracy of your information. This signature affirms your acknowledgment of the rules surrounding the exemption.

- Provide the date of signing. Accurate dating is important for record-keeping and validation of your exemption request.

- Complete page 2 if you have multiple accounts or meters for which the exemption is claimed. List only those accounts and meters on this page.

- Once you have filled out all necessary sections, save any changes made to the form, and then download, print or share the completed form as needed.

Begin completing the FL FPL Form 6037A online today to secure your sales tax exemption.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.