Loading

Get Pbgc Model Separate Interest Qdro Qualified Domestic Relations Order 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

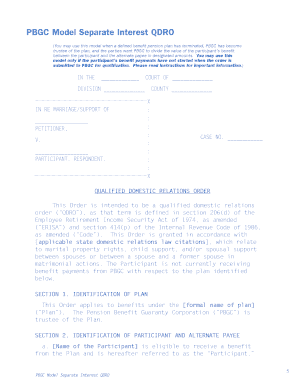

How to fill out the PBGC Model Separate Interest QDRO online

This guide provides a clear and supportive walkthrough for users seeking to complete the PBGC Model Separate Interest Qualified Domestic Relations Order online. Whether you are familiar with legal documents or new to the process, this guide is designed to offer step-by-step instructions tailored to your needs.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the document and open it for completion.

- In the first section, identify the court where the order will be filed. Fill in the relevant names of the court, division, and case number as needed.

- In Section 1, specify the formal name of the pension plan that the order applies to. Ensure that you include the correct identification for accuracy.

- In Section 2, provide the names of both the Participant and the Alternate Payee. Include their mailing addresses and Social Security Numbers, ensuring all information is accurate and up-to-date.

- In Section 3, indicate the specific amount of benefit to be paid to the Alternate Payee. This includes specifying the amount or percentage of the Participant’s benefit as designated.

- In Section 4, outline how benefit adjustments will be handled if there are any changes to the Participant’s benefit. Be clear about the methodology for applying reductions and increases.

- In Section 5, write down the date when payments to the Alternate Payee will commence. Ensure this date complies with the requirements outlined in the guidelines.

- In Section 6, specify the form in which the Alternate Payee will receive their benefit as chosen on the PBGC benefit application.

- In Section 8, address how the payments will continue after the death of the Participant. Clarify that the death does not affect the Alternate Payee’s eligibility.

- In Section 9, determine the consequences if the Alternate Payee passes away before benefits commence. Choose the appropriate language regarding the disposition of their separate interest.

- In Section 10, if applicable, elaborate on the surviving spouse rights of the Alternate Payee, ensuring correct options are selected.

- In Section 11, acknowledge any limitations or requirements that PBGC has regarding benefit payments, ensuring that all conditions are met.

- Complete Section 12 by confirming the court's reservation of jurisdiction to amend the order as needed.

- Finally, enter the date and signature of the presiding judge, concluding the document where required.

- After filling out all sections, you can save changes, download, print, or share the completed document as needed.

Begin your process by completing the PBGC Model Separate Interest QDRO online today.

Shared Payment. A Qualified Domestic Relations Order, or QDRO (“quadro” ), is an order drafted by an attorney that allows retirement funds to be used to pay for things like alimony (spousal maintenance) or portions of marital property during divorce.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.