Loading

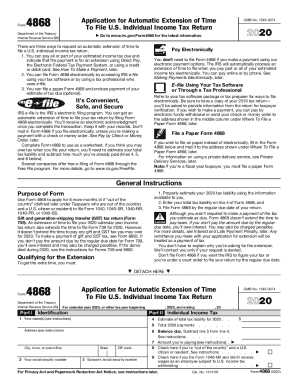

Get 2020 Form 4868. Application For Automatic Extension Of Time To File U.s. Individual Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2020 Form 4868. Application for Automatic Extension of Time to File U.S. Individual Income Tax online

This guide provides clear, step-by-step instructions for completing the 2020 Form 4868, which is used to apply for an automatic extension of time to file your U.S. individual income tax return. Whether you're new to tax forms or have some experience, this guide will help you navigate the process smoothly and efficiently.

Follow the steps to properly complete your tax extension application.

- Click 'Get Form' button to obtain the form and open it in your preferred document editor.

- Begin by entering your identification information. On Part I, line 1, include your name(s) as they will appear on your tax return. If filing jointly, list both names in the order they will appear on your return.

- Next, provide your social security number (SSN) on line 2, and if applicable, your partner's SSN on line 3. Make sure these numbers are accurate to prevent processing delays.

- On line 4, estimate your total tax liability for 2020. This should reflect what you project to report on your tax return.

- On line 5, enter the total payments you expect to report for 2020, excluding the payment made with this form.

- Calculate the balance due by subtracting line 5 from line 4, and enter this amount on line 6.

- On line 7, indicate any amount you are paying with this form to reduce the balance due, if applicable. Remember, payments can help minimize potential interest or penalties.

- If you are a U.S. citizen or resident currently out of the country, check the box on line 8. This can affect your filing deadline.

- If you are filing Form 1040-NR and did not receive wages subject to U.S. tax withholding, check the box on line 9.

- Once all fields are filled out correctly, save your changes. You can download, print, or share the completed form as needed.

Complete your Form 4868 online today to ensure your tax extension request is submitted timely and accurately.

An extension gives you until October 16, 2023, to file your 2022 federal income tax return. You can use IRS Free File at IRS.gov/freefile to request an automatic filing extension or file Form 4868, Application for Automatic Extension of Time to File.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.