Loading

Get How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single 2011 online

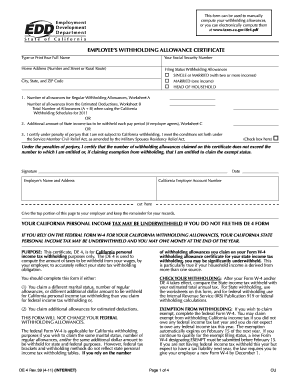

Filling out the How To Fill The Form De 4 Employees Withholding Allowance Certificate is essential for determining your state income tax withholding as a single individual. This guide will help you navigate each section of the form to ensure accurate completion.

Follow the steps to accurately fill out your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Type or print your full name in the designated field.

- Enter your Social Security Number in the appropriate section.

- Provide your home address, including street number and name, and other required address details.

- Select your filing status by checking the appropriate box for 'single' or any other relevant category.

- Fill in your city, state, and ZIP code.

- Determine the number of regular withholding allowances using Worksheet A. Enter the total allowances in the designated box.

- If applicable, indicate any additional amount of state income tax you wish to withhold using Worksheet C.

- If you qualify for exemption from withholding, check the corresponding box and read the requirements carefully.

- Sign and date the form to certify the information is accurate and truthful.

- Ensure your employer's name and address are filled in as required.

- Save changes, download, print, or share the form as needed.

Complete your documents online with confidence and accuracy.

Claiming 1 on Your Taxes It just depends on your situation. If you are single, have one job, and have no dependents, claiming 1 may be a good option. If you are single, have no dependents, and have 2 jobs, you could claim both positions on one W-4 and 0 on the other.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.