Loading

Get R1376

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R1376 online

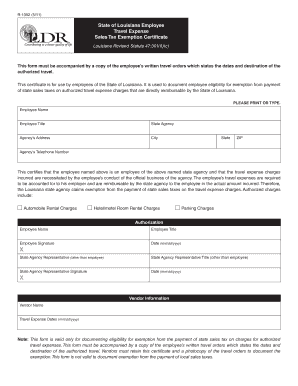

This guide provides a comprehensive overview of the R1376 form, aimed at helping users understand each step in filling it out online. Whether you are familiar with digital forms or new to this process, you will find clear instructions to assist you.

Follow the steps to complete the R1376 form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Begin by entering the employee's name and title in the designated fields. Ensure that these entries are accurate and legible.

- Next, provide the state agency's name along with the agency's address, which includes the city, state, and ZIP code.

- Input the agency’s telephone number in the specified format, ensuring it is correct for any follow-up communications.

- Certify the employee's status by confirming that they are authorized to conduct official business. This section includes a declaration of exemption from state sales taxes on incurred travel expenses.

- In the authorization section, the employee must sign and date the form. This verifies their agreement to the contents of the form.

- A state agency representative, different from the employee, must also sign, title, and date the form, indicating their approval.

- Complete the vendor information section by entering the vendor's name and the dates for the travel expenses incurred.

- Review all entries for accuracy before finalizing. Once completed, you can save your changes, download the form, print it, or share it as necessary.

Take the next step and complete your R1376 form online to ensure a smooth and efficient process.

Related links form

Form 16 may not be available due to various reasons, such as your employer not issuing it or technical issues on the portal. In some cases, delays in payment processing can also result in the unavailability of the form. If you find yourself unable to access Form 16, check with your employer or utilize resources like R1376 for follow-up guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.