Loading

Get Salmon Enhancement Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Salmon Enhancement Tax Return online

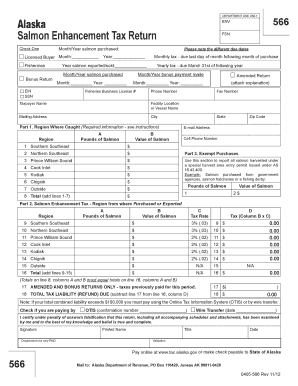

The Salmon Enhancement Tax Return is a critical document for those involved in the purchase and sale of salmon in Alaska. This guide will provide users with detailed, step-by-step instructions on how to accurately and efficiently complete the form online.

Follow the steps to successfully fill out the Salmon Enhancement Tax Return online:

- Click ‘Get Form’ button to access the Salmon Enhancement Tax Return and open it in your preferred online editor.

- Begin filling in your basic information. Enter the month and year when the salmon was purchased, specify whether you are a licensed buyer or a fisherman, and indicate the year when the salmon was exported or sold.

- Provide your taxpayer information, including your employer identification number (EIN) or social security number (SSN), phone number, and mailing address.

- In Part 1, select the region where the salmon was caught. Fill in the pounds and value of salmon for each region listed. Ensure that the total pounds and total value from all regions are calculated accurately.

- Proceed to Part 2, which focuses on the salmon enhancement tax based on the regions where the salmon was purchased or exported. For each region, enter the pounds of salmon and their corresponding value, as well as the tax rate applicable to that region. Calculate the tax due for each region.

- In Part 3, report any exempt purchases. Ensure to include any salmon harvested under special permits and indicate the amounts accordingly.

- Review all sections for accuracy. Ensure that the totals on line 8 (Part 1) match with the totals on line 16 (Part 2). If applicable, complete the amended return section detailing previously paid taxes.

- Sign and date the return at the bottom of the document, certifying the information is true and complete.

- Once completed, save your changes, download the form, and print it for your records. You may also share it as needed.

Complete your Salmon Enhancement Tax Return online today to ensure compliance and timely submission.

Since 1994, Alaska has been collecting a three percent tax on that catch and distributing it to state and local governments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.