Loading

Get Nz Ir596 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR596 online

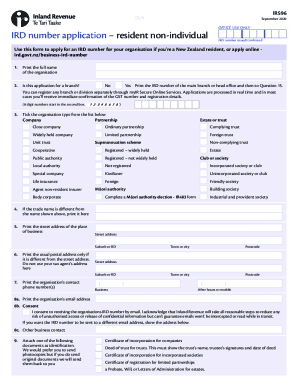

This guide provides clear and supportive instructions for completing the NZ IR596 form online. Whether you are new to filling out tax forms or have some experience, you will find detailed steps to assist you in obtaining an IRD number for your organisation.

Follow the steps to efficiently complete the NZ IR596.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Print the full name of the organisation as it is officially listed. Ensure accuracy to avoid any processing delays.

- Indicate if this application is for a branch by selecting ‘Yes’ or ‘No’. If ‘Yes’, print the IRD number of the main branch or head office.

- Choose the appropriate organisation type from the provided list. This is crucial as it determines the specific tax obligations.

- If your trade name differs from the official name, please print it in the designated field.

- Provide the street address of your place of business. If the postal address is different, input that as well. Avoid using a tax agent’s address.

- Enter the organisation’s contact phone numbers. This contact information will be used for any inquiries.

- Fill in the organisation's email address and consent to receive the IRD number by email. You can provide an alternative email address if desired.

- Attach a copy of one of the acceptable identification documents as specified in the form. It is preferred to submit photocopies.

- Specify the organisation’s start date accurately. If there is a different start date for taxable activities, mention it.

- Provide a business description and select the appropriate industry code as per the guidelines provided.

- Answer the questions regarding expected annual turnover and employment intentions. If applicable, complete the associated forms as mentioned.

- For companies, indicate whether fringe benefits will be provided to shareholder-employees.

- List the names, addresses, and IRD numbers of any relevant stakeholders, such as shareholders or trustees.

- Input your bank account details accurately to ensure correct processing of any financial transactions.

- Print the full name of the contact person within the organisation along with their phone number for communication purposes.

- Complete the declaration, including the name and designation of the authorised person, followed by their signature and date.

- After reviewing all the filled information for accuracy, save changes, and proceed to download or print the completed form.

Complete your NZ IR596 form online today for a smooth submission process!

NZ's IRD number is a unique number issued by Inland Revenue to customers, both individuals and non-individuals (such as Companies, Partnerships, Trusts, Charities), and is usually used for the lifetime of a customer (other than when a person is declared bankrupt).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.