Loading

Get Ma Taba-1 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA TABA-1 online

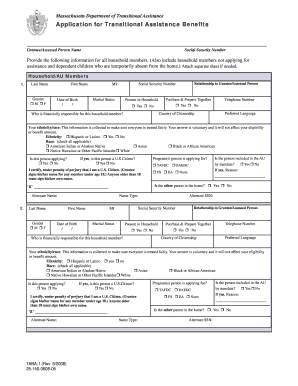

Completing the MA TABA-1 form can be straightforward with the right guidance. This user-friendly guide will walk you through each section of the form to ensure that you provide all necessary information accurately and completely.

Follow the steps to successfully complete the MA TABA-1 form:

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the grantee or assessed person's name in the designated field at the top of the form.

- Provide the Social Security Number (SSN) for the grantee or assessed person in the specified area.

- List all household members in the provided section. Include both those applying for assistance and those not applying. You may attach a separate sheet if necessary.

- For each household member, fill in their last name, first name, gender, marital status, and date of birth.

- Indicate the relationship of each household member to the grantee or assessed person.

- Provide the Social Security Number for each household member, if applicable.

- Check whether the household member is present in the household and indicate their preferred language and country of citizenship.

- Respond to the ethnicity/race question. Remember, answering this question is voluntary and will not affect eligibility.

- Indicate the programs for which the person is applying, such as TAFDC, FS, or EAEDC.

- Make sure each adult member signs the declaration certifying U.S. citizenship under penalty of perjury.

- Review the entire form for accuracy, ensure all required information is filled out, then save the changes, download, print, or share the completed form.

Complete the MA TABA-1 form online today to apply for transitional assistance benefits!

You should file your MA Form 1 with the Massachusetts Department of Revenue, as detailed in MA TABA-1 requirements. It's crucial to ensure it reaches the correct department to avoid delays. The uslegalforms platform can guide you through this process, ensuring your form is completed and submitted correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.