Loading

Get Sba Form 1086

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 1086 online

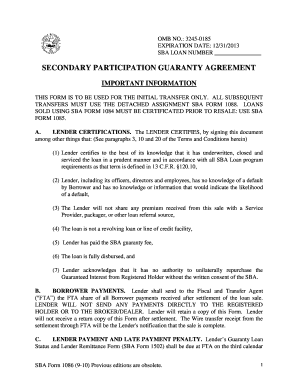

Filling out the Sba Form 1086 is an essential step for lenders involved in the secondary market for guaranteed loans. This guide offers clear instructions on how to complete the form online efficiently and accurately, ensuring compliance with all requirements.

Follow the steps to successfully fill out the Sba Form 1086 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the lender's and borrower's information in Section I. This includes the lender's name, the borrower’s name, and their respective addresses, ensuring accuracy in the details provided.

- In the lender’s certifications section, check the boxes to certify compliance with the terms outlined, including details such as the SBA loan authorization date and the outstanding principal amount.

- Indicate the interest rates applicable to both the guaranteed and unguaranteed portions of the loan. Make sure to choose between 'fixed' and 'variable' rates as per the loan's terms.

- Fill in the payment modification details if applicable. Remember, for a deferral of payments, ensure to document it clearly to avoid misunderstandings.

- Review all entries in the form for accuracy before submission. Inaccurate information can lead to complications in processing.

- Once satisfied with the completed form, proceed to save changes. You will have options to download, print, or share the form as per your requirements.

Complete your Sba Form 1086 online now to ensure a smooth and efficient process!

Form 1086, known as the Sba Form 1086, is instrumental for borrowers seeking funding through the SBA. It captures key details about the proposed project and the borrower's financial status. Completing this form accurately enhances the prospects of your application being approved. Accessing resources from US Legal Forms can assist in managing this form effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.