Loading

Get Oh Sao/lgrp-rc3 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OH SAO/LGRP-RC3 online

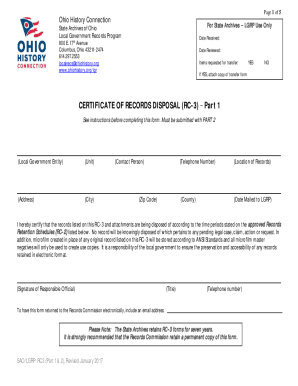

The OH SAO/LGRP-RC3 form is essential for local government entities in Ohio to certify the disposal of records according to approved retention schedules. This guide will walk you through the online process of filling out this form, ensuring a smooth experience.

Follow the steps to complete the OH SAO/LGRP-RC3 online successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1 of the form. Fill in the Local Government Entity name and Unit details. Provide the address, city, zip code, contact person's name, and telephone number. Make sure this information is accurate as it serves as the primary identification for the records.

- Indicate if items are requested for transfer by selecting YES or NO. If YES, ensure you attach a copy of the transfer form as required.

- In the certification section, confirm that the records listed will be disposed of according to the approved Records Retention Schedules. State your understanding that no record will be disposed of that pertains to any pending legal case.

- Include your signature as a responsible official, along with your title and telephone number.

- Provide an email address if you wish the form to be returned electronically to the Records Commission.

- Next, proceed to Part 2 of the form. Fill in the Political Subdivision Name and provide the Records Series Title, Authorization for Disposal Schedule number, and the date it was approved by the Records Commission.

- Specify the media type to be destroyed and the media type to be retained, if applicable.

- Enter the inclusive dates of records by filling in the 'From' and 'To' fields.

- State the proposed date of destruction, ensuring it aligns with the 15 business days requirement from the receipt by the LGRP.

- Upon completing both parts of the form, review all entries for accuracy, save your changes, and make sure to download, print, or share the form as necessary.

Complete your documents online today to ensure compliance and efficient record management.

Pursuant to section 5751.12 of the Revised Code, all records must be maintained for a period of four years from the later of the filing of or the due date of the return covering the period to which the records relate unless the commissioner either consents in writing to their earlier destruction or, by written order, ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.