Loading

Get Nc Nc-br 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC NC-BR online

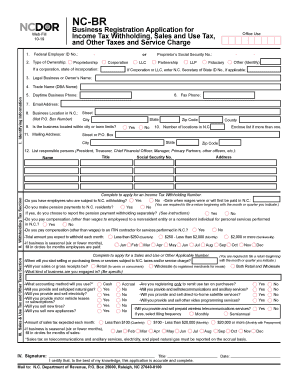

The NC NC-BR form is essential for businesses registering for income tax withholding, sales and use tax, and other applicable charges in North Carolina. Completing this form accurately is crucial for compliance with state tax regulations.

Follow the steps to complete and submit the NC NC-BR form online.

- Click 'Get Form' button to obtain the form and open it in the editor. This allows you to start filling out the necessary sections.

- Fill out Section I. Identifying Information. Use blue or black ink if printed. Enter your Federal Employer Identification Number or, for sole proprietorships, the owner's Social Security Number. Ensure to provide the legal business name as per incorporation documents.

- Complete all fields in Section II if you are applying for an Income Tax Withholding Number. Indicate if you have employees subject to N.C. withholding and any pension payments.

- Move to Section III to apply for a Certificate of Registration for sales and use tax. Specify the start date of sales and what type of business you are engaged in.

- In Section IV, ensure the application is signed and dated by the appropriate authorized person to validate the information provided.

- Once completed, save your changes, download, print, or share the form as required before submission.

Complete your NC NC-BR form online to ensure your business complies with North Carolina tax regulations.

Mailing an Application to Reserve a Business Entity Name to the North Carolina Department of the Secretary of State along with the $30 filing fee. Or, by filling the form out online.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.