Loading

Get Ms Dor Form 80-110 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR Form 80-110 online

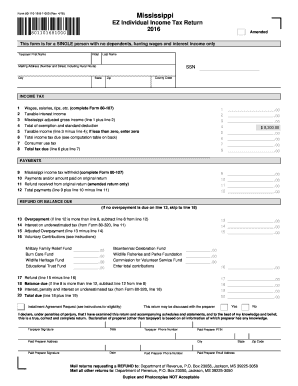

Filling out the MS DoR Form 80-110 online is a straightforward process designed for individuals seeking to file their individual income tax return efficiently. This guide offers clear, step-by-step instructions to ensure a smooth completion of the form, even for those with limited experience in filing taxes.

Follow the steps to complete your tax return accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with the taxpayer information section. Enter your first name, initial, and last name as required. Make sure to fill in your mailing address, city, state, county code, and zip code accurately.

- Provide your Social Security number in the designated field.

- In the income tax section, enter your wages, salaries, tips, and any taxable interest income as prompted. You will need to complete Form 80-107 for this information.

- Calculate your Mississippi adjusted gross income by adding the amounts from lines 1 and 2, and enter the total on line 3.

- Deduct the total of exemptions and standard deductions from your adjusted gross income on line 4, and then enter the resulting taxable income on line 5.

- Consult the income tax computation table to determine the total income tax due and input this amount on line 6.

- If applicable, complete the consumer use tax on line 7.

- Add the amounts from lines 6 and 7 to calculate the total tax due and enter that amount on line 8.

- If you have any Mississippi income tax withheld, enter that amount on line 9, and also input any payments or amounts paid on the original return on lines 10 and 11, respectively.

- Calculate the total payments by combining the amounts from lines 9 and 10, then subtracting line 11, entering the final amount on line 12.

- If you have an overpayment, note this on line 13 and account for any interest on underestimated tax on line 14. Enter the adjusted overpayment on line 15.

- Calculate and enter any voluntary contributions on line 16, and then determine your refund amount by subtracting any contributions from the adjusted overpayment.

- Lastly, if there is a balance due, calculate that on line 18 and add any late payment penalties on line 19. Enter the total due on line 20.

- After completing all sections of the form, you can save your changes, download a copy for your records, or print the form if you need a physical copy to share.

Get started on your MS DoR Form 80-110 now, and ensure your tax return is filed correctly and efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Internal Revenue Service (IRS) administers and enforces U.S. federal tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.