Loading

Get Mi Cf-2210 - Grand Rapids 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI CF-2210 - Grand Rapids online

Filling out the MI CF-2210 - Grand Rapids form online is a straightforward process that ensures you can accurately calculate any penalties or interest on underpaid estimated taxes. This guide provides a clear, step-by-step approach to assist you in completing the form effectively.

Follow the steps to complete your MI CF-2210 - Grand Rapids form online.

- Click the ‘Get Form’ button to access the MI CF-2210 - Grand Rapids form. This will open the document in an online environment for you to fill out.

- Enter your name and social security number in the designated fields at the top of the form. Make sure the information entered matches your official documentation.

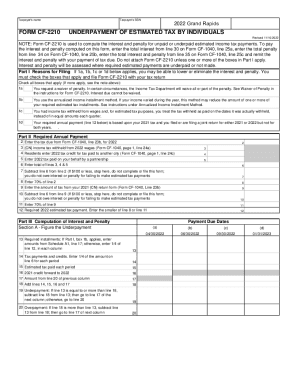

- In Part I, check all applicable reasons for filing this form. Select from options relating to penalty waivers and annualized income installment methods as relevant to your situation.

- Progress to Part II and input the required annual payment values. Include the tax due, withheld income tax, tax credits for payments made to other cities, and any partnership taxes.

- Calculate the difference in line 7. If the amount is $100 or less, you may stop here as you do not owe further penalties.

- In Part III, begin filling out Section A to figure the underpayment by entering the required installments.

- Proceed to Section B and input the interest amounts due based on the underpayment calculations.

- In Section C, calculate the penalty based on the number of months the underpayment persisted and the applicable penalty rates.

- Finally, sum the total interest and penalty in Section D and enter the total on the appropriate lines of Form CF-1040.

- Once you have filled in all sections, ensure to save your changes, download, print, or share the MI CF-2210 as needed to complete the filing process.

Complete your MI CF-2210 - Grand Rapids form online today to stay compliant and avoid unnecessary penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Michigan City Income Tax Rates CityState RateTotal City and State RateDetroit4.25%6.65%East Lansing4.25%5.25%Flint4.25%5.25%Grand Rapids4.25%5.75%20 more rows • Jan 1, 2023

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.