Loading

Get Form No. 10-iform No. 10a (see Rule 17a) - Income Tax Departmentform No. 10-icbdt Notifies Form No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO. 10-IFORM NO. 10A (See Rule 17A) - Income Tax Department FORM NO. 10-ICBDT Notifies Form No online

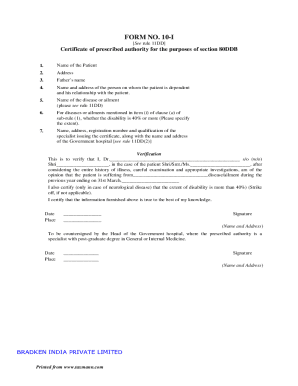

Filling out the FORM NO. 10-IFORM NO. 10A is an essential process for individuals seeking to certify certain medical conditions under the Income Tax provisions. This guide provides clear and detailed instructions on completing each section of the form efficiently.

Follow these steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the form and open it in your document editor.

- In the address section, enter the complete residential address of the patient for verification purposes.

- Next, record details of the person on whom the patient is dependent, including their name, address, and relationship with the patient.

- Specify the name of the disease or ailment for which the certificate is being issued. Refer to rule 11DD for the list of eligible ailments.

- If the disease or ailment is detailed in clause (a) of sub-rule (1), indicate whether the disability is 40% or more. Specify the extent if applicable.

- Provide the name, address, registration number, and qualification of the specialist issuing the certificate, along with the Government hospital's details as prescribed in rule 11DD(2).

- Include the date and place, and ensure your signature is appended to validate the information provided.

- If applicable, include a countersignature from the Head of the Government hospital, along with their date, place, and signature for validation.

- Finally, you may save changes to the form, download it for records, print it for submission, or share it as needed.

Complete your form online to ensure efficient processing of your tax-related medical certifications.

This is optional. Form 10-IC is required to filed only if a Domestic Company chooses to pay tax at concessional rate of 22% under Section 115BAA of the Income Tax Act,1961.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.