Loading

Get 2012 Ri Form 7695e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ri Form 7695e online

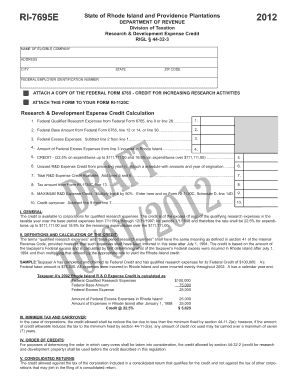

The 2012 Ri Form 7695e is used to claim the research and development expense credit in the state of Rhode Island. This guide provides clear and detailed instructions on how to complete the form effectively to maximize your credit.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the eligible company in the designated field. Ensure the name matches the legal entity's registered name.

- Fill in the address, city, state, and zip code of the company. Verify this information for accuracy as it will be used for correspondence.

- Input the federal employer identification number. This number is essential for tax identification purposes.

- Attach a copy of the Federal Form 6765 – Credit for Increasing Research Activities. Make sure that the copies are clear and complete.

- Provide the federal qualified research expenses from Federal Form 6765, either from line 9 or line 28, in the appropriate section.

- Input the federal base amount from Federal Form 6765, either from line 12, 14, or line 30.

- Calculate the federal excess expenses by subtracting the federal base amount from the qualified research expenses.

- Indicate the amount of federal excess expenses incurred specifically in Rhode Island.

- Calculate the credit based on the parameters provided, which includes 22.5% for expenditures up to $111,111.00 and 16.9% for expenditures beyond that.

- Enter any unused R&D expense credits from previous years and attach a schedule detailing amounts and origination years.

- Add the credit calculated and the unused credits to determine the total R&D expense credit available.

- Record the tax amount from Form RI-1120C, line 13, to determine the maximum R&D expense credit.

- Calculate the credit carryover by subtracting the maximum R&D expense credit from the total available credit.

- Review all fields for accuracy, then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure you maximize your research and development credit.

Recording the R&D tax credit involves documenting your eligible expenses and activities in accordance with the IRS guidelines. Utilize the 2012 Ri Form 7695e to accurately reflect these expenses on your tax return. For thorough guidance and access to necessary forms, consider using US Legal Forms to streamline the recording process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.