Loading

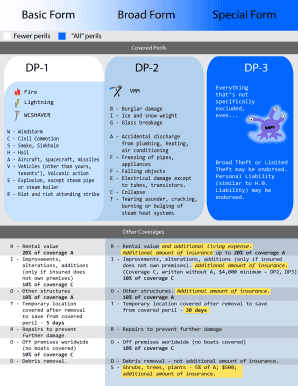

Get Dp-1 Dp-2 Dp-3 Basic Form Broad Form Special Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DP-1 DP-2 DP-3 Basic Form Broad Form Special Form online

Filling out the DP-1 DP-2 DP-3 Basic Form Broad Form Special Form online can be straightforward with the right guidance. This guide will provide you with clear instructions on how to complete each section of this essential document effectively.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to access the document and open it in the online editor.

- Begin with the basic information section. Enter your name, address, and other identifying details as required.

- Proceed to the coverage options. Select the type of form you are filing, whether it is DP-1, DP-2, or DP-3. Understanding the differences between these forms is crucial, as DP-1 covers fewer perils, while DP-3 includes more comprehensive coverage.

- Fill in the specific perils covered. For the DP-1 form, this includes fire, lightning, windstorm, and other specific risks. Make sure to review the list of perils thoroughly and check the boxes that apply to your situation.

- If you are completing the DP-2 form, include additional coverages such as vandalism, accidental discharge, and freezing of pipes. For the DP-3 form, indicate that you are opting for coverage against everything not specifically excluded.

- Complete the sections regarding personal liability if applicable. This could include additional endorsements for theft and coverage for improvements or alterations.

- Review all the filled-out information for accuracy. Ensure that each section is carefully completed and reflects your true circumstances.

- Once satisfied with your entries, save the document. You can then choose to download, print, or share the completed form as necessary.

Take the first step to secure your property by completing your forms online today.

The DP-3 form is the most comprehensive dwelling fire coverage available. It is an “open perils” or “all risk” policy, which means real property (dwelling and other structures) will be covered for all types of damage, except those exclusions named in the policy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.