Loading

Get Ky Net Profits License Fee Return - City Of Elizabethtown 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Net Profits License Fee Return - City Of Elizabethtown online

This guide provides step-by-step instructions for users on how to complete the KY Net Profits License Fee Return for the City Of Elizabethtown online. It aims to simplify the process and ensure that all necessary components are accurately filled out.

Follow the steps to successfully complete your return online:

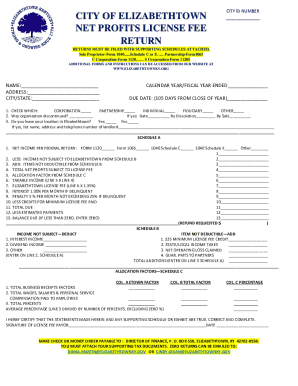

- Click the ‘Get Form’ button to acquire the KY Net Profits License Fee Return form and open it in your preferred online editor.

- Begin by entering your city ID number at the top of the form. Ensure this information is accurate, as it is crucial for identification.

- Fill in your name and address, including the city and state. Double-check the spelling and completeness to avoid any delays.

- Indicate the calendar year or fiscal year that your return covers, and note the due date, which is typically 105 days from the end of the year.

- Check the appropriate box to indicate your business structure: corporation, partnership, individual, fiduciary, or other. This helps categorize your return.

- If your organization has been discontinued, provide the date and select the method of discontinuation (dissolution or sale). This section helps clarify your business status.

- Answer whether you lease your business location in Elizabethtown. If yes, specify the landlord's name, address, and phone number.

- Move to Schedule A and report your net income as stated on your federal return. Tick the box corresponding to your federal return form.

- Deduct income not subject to Elizabethtown fees per Schedule B, then add non-deductible items from the same schedule.

- Calculate your total net profits subject to the license fee by adding and subtracting the amounts as required in lines 1 to 4 of Schedule A.

- Calculate your license fee by multiplying the taxable income (from line 6) by the rate of 1.35%.

- If your payment is late, calculate any interest or penalty based on the provided rates and include this in your totals.

- Enter any credits for minimum license fees paid, then compute the total due. Ensure that all calculations are correct to avoid errors.

- Subtract any estimated payments from the total due and calculate the balance. If the result is negative, enter zero.

- Sign and date the form to certify that the information provided is accurate. This finalizes the document and validates your submission.

- Finally, save your changes, then download, print, or share the completed form as needed. Remember to attach required supporting tax documents before submission.

Complete your KY Net Profits License Fee Return online today to ensure timely filing!

What is a net profits license fee return? An Annual Net Profit License Fee is levied on all persons, fiduciaries, corporations, and associations engaged in the occupation, trade, profession or other business earned for work performed within the city. The rate is equal to the greater of 1.95% of the net profit or $60.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.