Loading

Get Canada T2033 E 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2033 E online

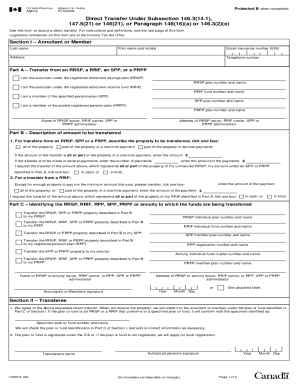

The Canada T2033 E form is essential for recording a direct transfer of retirement funds under various sections of the Income Tax Act. This guide provides clear and supportive instructions on how to complete the form online efficiently.

Follow the steps to accurately complete the Canada T2033 E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Section I, which requires entering the details of the annuitant or member. This includes the last name, first name, social insurance number, address, and telephone number.

- In Part A, indicate the type of account from which you are transferring funds: RRSP, RRIF, SPP, or PRPP. Fill in the respective plan number and name.

- Move to Part B and select how much you are transferring. Describe whether you are transferring all, part in a one-time payment, or part in several payments. Provide corresponding amounts as necessary.

- Continue to Part C and identify the account to which the funds are being transferred. Provide the necessary details including the plan number and the name of the new issuer.

- Review your information for accuracy. Ensure all sections are filled out completely to prevent processing delays.

- Once you have completed the form, you can save your changes, download a copy for your records, print it, or share it as required.

Start completing your T2033 E form online to ensure a smooth and efficient transfer process.

What is the Difference Between T2030 and T2033? Form T2030 is different from form T2033 as it details only direct transfers that need to be taxed. When you use form T2030 you are transferring money ing to the rules listed under subparagraph 60(I)(v) of the Income Tax Act.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.