Loading

Get Dc Form Ouctax-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC Form OUCTAX-1 online

Filling out the DC Form OUCTAX-1 online is a straightforward process designed to empower businesses in managing their unemployment compensation tax responsibilities efficiently. This guide will provide you with step-by-step instructions to ensure that your form is completed accurately and submitted without delays.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to access the DC Form OUCTAX-1 and open it in your preferred online editor.

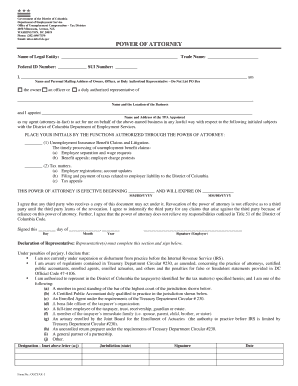

- In the first section, enter the name of the legal entity and trade name, followed by the federal ID number and SUI number.

- Provide the name and personal mailing address of the owner, officer, or duly authorized representative without using a P.O. Box.

- Specify the name and location of the business for which the power of attorney is being granted.

- Appoint a third-party agent by entering their name and address in the designated area.

- Initial next to the functions you authorize through the power of attorney, including unemployment insurance and tax matters.

- Fill in the effective dates for the power of attorney commencement and expiration.

- Sign and date the document, ensuring your signature is included along with the day, month, and year.

- If applicable, representatives must complete the declaration section, confirming their qualifications and authority.

- Finally, review all entered information for accuracy, and either save changes, download, print, or share the completed form.

Complete your DC Form OUCTAX-1 online today for efficient management of your unemployment compensation tax needs.

Related links form

How can I get my 1099-G tax form? For tax year 2021: UC 1099-G have been mailed to the last address of record prior to January 31, 2022. You can also view this form by logging into your Claimant Portal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.