Loading

Get Irs Form 886-h-eic 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 886-H-EIC online

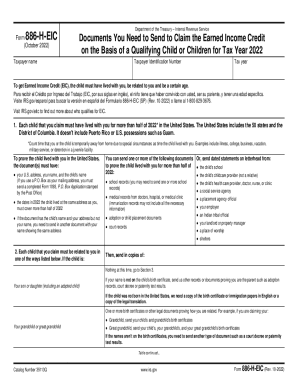

Filling out the IRS Form 886-H-EIC can seem daunting, but with the right guidance, you can navigate it with ease. This form is essential for documenting your eligibility for the Earned Income Credit based on qualifying children. In this guide, we will provide clear, step-by-step instructions on completing the form online.

Follow the steps to successfully complete your IRS Form 886-H-EIC.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Begin by filling in your taxpayer name and taxpayer identification number at the top of the form. Ensure that these details match your official documents.

- Indicate the tax year for which you are claiming the Earned Income Credit. For this form, it should be set to 2022.

- In the first section, provide the necessary documentation to prove that each child claimed lived with you for more than half of the tax year 2022. Include any relevant documents such as school records or healthcare provider letters that display your name, the child’s name, and your shared address.

- For each child, specify the relationship to you following the guidelines listed on the form. Attach appropriate legal documentation for verification, such as birth certificates or court records, to confirm the relationship.

- Document the age of each child you are claiming. Ensure you have records that indicate their age aligns with the requirements for the Earned Income Credit.

- Review all the filled-out sections to ensure accuracy. Cross-check that you have included all necessary documents and that they pertain to the year 2022.

- Once you have completed the form, save any changes. Then, download, print, or share the form as necessary, ensuring you keep a copy for your records.

Begin completing your IRS Form 886-H-EIC online today to claim your Earned Income Credit.

The parent with the highest adjusted gross income (AGI) if the child lived with each parent for the same amount of time during the tax years, and they do not file a joint return together; The person with the highest AGI, if no parent can claim the child as a qualifying child; or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.