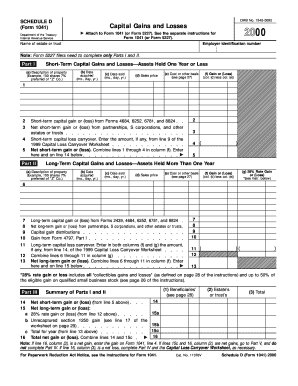

Get 2000 Form 1041 (schedule D). Capital Gains And Losses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Form 1041 (Schedule D). Capital Gains And Losses online

Filling out the 2000 Form 1041 (Schedule D). Capital Gains And Losses can be straightforward with the right guidance. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring you accurately report your estate or trust's capital gains and losses.

Follow the steps to fill out the form correctly.

- Locate the ‘Get Form’ button to access the 2000 Form 1041 (Schedule D) and open it in an online editor.

- In the first section, enter the name of the estate or trust along with the employer identification number at the top of the form.

- Proceed to Part I, where you'll report short-term capital gains and losses for assets held one year or less. Fill in the columns for the description of property, dates acquired and sold, sales price, cost or other basis, and calculate gain or loss.

- Next, move to Part II to document long-term capital gains and losses for assets held more than one year. Again, input the required information in the corresponding fields.

- Complete Part III by summarizing the results from Parts I and II, where you'll list net short-term and long-term gains or losses.

- Finally, fill out Part IV if applicable, which addresses capital loss limitations. Determine and enter the smaller loss on the specified line.

- After all fields are completed, you can save the changes, download the filled form, print it for your records, or share it as needed.

Get started with your online filing today to ensure a smooth process.

Filing Schedule D may seem complex, but understanding the components can simplify the process. 2000 Form 1041 (Schedule D) requires gathering relevant data, but using resources like UsLegalForms can guide you through each step. With proper organization and a clear understanding of your capital transactions, many taxpayers find the task manageable. Remember that tax professionals are also available for help if you feel uncertain.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.