Loading

Get Irs 720 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 720 online

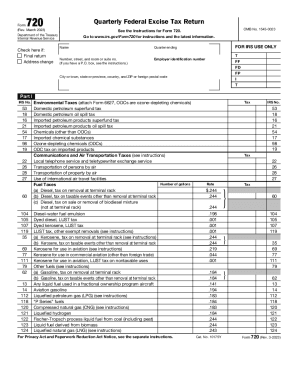

Filing the IRS Form 720 is essential for reporting federal excise taxes. This guide will help you navigate through each section of the form efficiently and accurately, ensuring that you meet all necessary requirements.

Follow the steps to complete the IRS 720 online.

- Use the ‘Get Form’ button to access the IRS 720 form and open it in your editor of choice.

- Fill in your name and address details, including the number, street, city, state, and zip code in the designated fields.

- Enter your Employer Identification Number (EIN) in the appropriate field to identify your business.

- Specify the quarter ending by selecting the correct date that corresponds to your filing period.

- Proceed to Part I of the form, where you will report your excise tax liabilities. Select the relevant taxes applicable to your business and fill in the corresponding amounts.

- In Part II, report any Patient-Centered Outcomes Research Fees applicable to your specified health insurance policies or self-insured health plans.

- Part III details your total tax liability. Add the amounts from the previous parts and calculate your balance due or any overpayment you wish to apply to future returns.

- Complete the section for Third Party Designee if you wish to authorize another person to discuss this return with the IRS.

- Review all entries for accuracy before signing the form. Add your signature, date, and print your name.

- Once you have completed filling out the form, you can save your changes, download, print, or share the form as needed.

Start preparing your IRS 720 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 720 (Quarterly Federal Excise Tax Return) Form 720 is reported quarterly to the IRS, in any year that foreign life insurance premiums were paid.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.