Loading

Get Tax Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Application online

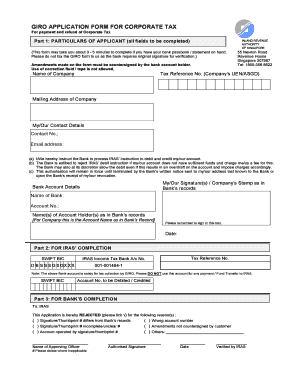

Completing the Tax Application online can streamline your corporate tax payment and refund process. This guide provides detailed steps and instructions to help you navigate the form efficiently.

Follow the steps to complete your Tax Application form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the particulars of the applicant by providing the company name, tax reference number (Company’s UEN/ASGD), and the mailing address of the company. Make sure all fields are completed accurately.

- Enter your contact details including a contact number and email address. This information will be essential for communication regarding your application.

- In the authorization section, acknowledge the instructions regarding bank processing. Clearly state your agreement by marking the appropriate boxes and prepare to provide your signature or company stamp.

- Complete the bank account details section by listing the bank name, account number, and the name of the account holder as per the bank’s records.

- Ensure to sign in the designated box to validate the application. Remember that amendments require countersigning by the bank account holder.

- Take a moment to review the entire form for accuracy before proceeding. Errors could lead to rejection by the bank or other authorities.

- Once completed, save your changes. You can also download, print, or share the form as needed before final submission.

Complete your Tax Application online today to simplify your corporate tax payment process.

Virginia. Who's Eligible: To qualify for Virginia's one-time stimulus tax rebate, you must have filed a 2021 Virginia income tax return by November 1, 2022, and have a 2021 Virginia net tax liability (you can still get a rebate if you received a refund after filing your 2021 state return).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.