Get Gsccca Pt 61 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gsccca Pt 61 Form online

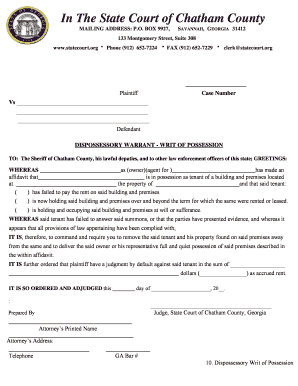

The Gsccca Pt 61 Form is essential for initiating legal proceedings related to dispossession cases in Chatham County. Filling out this form online is straightforward and ensures compliance with state requirements.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the plaintiff's details at the top of the form, including the mailing address and case number.

- Specify the defendant’s name in the corresponding section.

- Indicate whether the plaintiff is the owner or an agent, and provide the tenant's information, including their name and address.

- Select the relevant reasons for filing the dispossessory warrant by checking the appropriate boxes, such as failure to pay rent or holding over beyond the lease term.

- Complete any additional information necessary for the case, ensuring all details are filled accurately.

- Sign and date the form to affirm its validity. If applicable, include the attorney’s printed name, address, telephone number, and Georgia Bar number.

- Review the completed form for accuracy and completeness before submitting.

- Once satisfied, you can save the changes, download, print, or share the form as needed.

Ensure all your documents are properly completed online for a smooth filing process.

Filing a quitclaim deed in Georgia involves several key steps. First, ensure you have the correct quitclaim deed form, which typically requires details about the property and the parties involved. After completing the form, you need to sign it in the presence of a notary public and then file it with your county's clerk of superior court. For added convenience, you can also utilize the Gsccca PT 61 Form to ensure your property records remain accurate and up to date.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.