Loading

Get E11 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E11 Form online

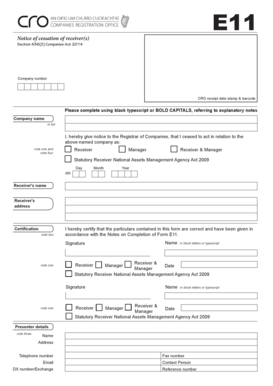

The E11 Form, a notice of cessation of receiver(s), is an essential document for notifying the Registrar of Companies regarding the cessation of a receiver's role in a company. This guide offers detailed instructions to help you successfully complete the E11 Form online.

Follow the steps to fill out the E11 Form correctly

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Enter the company number provided to uniquely identify the company in question.

- Input the company name in full, ensuring it matches the registered name with the Registrar of Companies.

- Indicate your role by selecting the appropriate option: Receiver, Manager, or Receiver & Manager. Ensure to tick the relevant box.

- Fill in the date of cessation, specifying the day, month, and year when you ceased to act in relation to the company.

- Provide your name and address as the receiver. This should reflect your current contact information.

- Finalize the certification section by certifying that the details entered are correct and comply with the completion notes. Add your signature and date.

- Complete the presenter details section with relevant information about the person submitting the form, including name, address, telephone number, email, and any additional required contact information.

- Review the entire form to ensure all sections are completed accurately. If additional space is required, include a continuation sheet as needed.

- Once you are satisfied with the form, save your changes and proceed to download or print the completed E11 Form for submission.

Complete your E11 Form online today to ensure compliance and timely notification to the Registrar of Companies.

Related links form

Form P-10 is a quarterly tax return to remit payroll expense tax of 1/2 of 1% (0.005) of gross compensation paid to employees who are performing work or services in the City of St. Louis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.