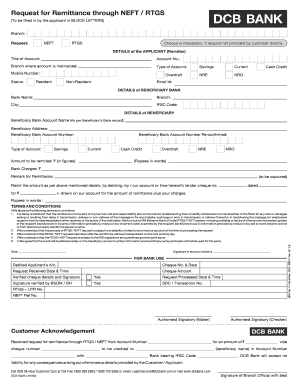

Get India Dcb Bank Request For Remittance Through Neft/rtgs 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign India DCB Bank Request for Remittance through NEFT/RTGS online

How to fill out and sign India DCB Bank Request for Remittance through NEFT/RTGS online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Securing a legal professional, arranging a planned appointment, and visiting the office for a confidential discussion makes completing an India DCB Bank Request for Remittance via NEFT/RTGS from start to finish exhausting.

US Legal Forms assists you in swiftly generating legally enforceable documents based on pre-made online templates.

Easily generate an India DCB Bank Request for Remittance via NEFT/RTGS without needing to consult professionals. We currently have over 3 million clients benefiting from our exclusive collection of legal forms. Join us today and access the top library of online templates. Experience it for yourself!

- Obtain the India DCB Bank Request for Remittance via NEFT/RTGS you need.

- Access it with an online editor and begin modifying.

- Fill in the missing sections; involved parties' names, addresses, and numbers, etc.

- Replace the blanks with specific fillable fields.

- Add the date/time and place your electronic signature.

- Click on Done after thoroughly reviewing all the information.

- Store the finalized document on your device or print it out as a physical copy.

How to modify Get India DCB Bank Application for Remittance via NEFT/RTGS 2018: personalize forms online

Take advantage of the functionality of the versatile online editor while filling out your Get India DCB Bank Application for Remittance via NEFT/RTGS 2018. Utilize the array of tools to swiftly complete the empty spaces and provide the needed information immediately.

Preparing documents is tedious and costly unless you possess ready-to-use fillable templates that you can complete digitally. The simplest method to handle the Get India DCB Bank Application for Remittance via NEFT/RTGS 2018 is to utilize our expert and multifunctional online editing tools. We equip you with all the necessary instruments for quick form completion and allow you to amend any forms to meet specific requirements. Additionally, you can comment on the changes and leave notes for other stakeholders.

Handling the Get India DCB Bank Application for Remittance via NEFT/RTGS 2018 in our powerful online editor is the quickest and most efficient means to organize, submit, and share your documents as you require from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All forms you generate or prepare are securely stored in the cloud, so you can always retrieve them when needed, ensuring they are not lost. Cease spending time on manual document filling and discard paper; accomplish everything online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Signature options.

- Emphasize important aspects with a preferred color or underline them.

- Mask sensitive data using the Blackout feature or simply delete them.

- Add images to illustrate your Get India DCB Bank Application for Remittance via NEFT/RTGS 2018.

- Replace the initial wording with one that aligns with your needs.

- Insert remarks or sticky notes to notify others about the changes.

- Include additional fillable fields and assign them to specific individuals.

- Secure the template with watermarks, add dates, and bates numbers.

- Distribute the document in various ways and save it on your device or cloud in different formats after completing the modifications.

Yes, Non-Resident Indians (NRIs) can utilize NEFT for sending remittances. They just need to ensure that their Indian bank account is enabled for such transactions, including those at India DCB Bank. This facility allows NRIs to make quick and convenient remittances back home, enhancing financial support for family and friends.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.