Loading

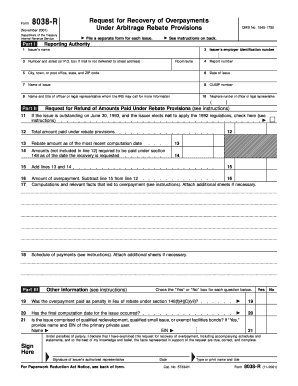

Get Recovery Of Overpayment Of Arbitrage Rebate Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Recovery Of Overpayment Of Arbitrage Rebate Form online

Completing the Recovery Of Overpayment Of Arbitrage Rebate Form is essential for issuers of state and local bonds seeking to recover overpayments made under arbitrage rebate provisions. This guide provides clear, step-by-step instructions to help you successfully fill out the form online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the issuer's name, employer identification number, address, report number, city, state, and ZIP code. Provide the date of issue and the name of the bond issue, along with the CUSIP number if applicable.

- Proceed to Part II, where you will indicate if the issue is outstanding on June 30, 1993, and if the issuer elects not to apply the 1992 regulations. Enter the total amount paid under rebate provisions and the rebate amount as of the most recent computation date.

- Fill in the amounts required under section 148 that are not included in the total paid. Sum these values to find the total amounts from previous steps.

- Calculate the amount of overpayment by subtracting the sums from the previous calculations. Document the computations and relevant facts that led to the overpayment in the specified area.

- In Part III, answer the questions regarding the overpayment, including whether it was paid as a penalty or if the issue is comprised of qualified bonds, and provide the name and EIN of the primary private user if applicable.

- Finally, sign the form, providing the signature of the authorized representative along with their printed name and title. Review all information for accuracy before submission.

- Save your changes, and choose to download, print, or share the form as needed.

Start completing your documents online today to ensure a smooth recovery process.

Related links form

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.