Get Rp 487

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rp 487 online

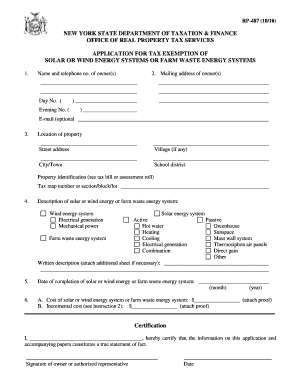

Filling out the Rp 487 form is a crucial step for users seeking tax exemption for solar or wind energy systems or farm waste energy systems in New York State. This guide will provide you with clear instructions on each section of the form to ensure a smooth application process.

Follow the steps to successfully complete the Rp 487 form online.

- Click the ‘Get Form’ button to access the online version of the Rp 487 form and open it in your preferred editor.

- Enter the name and telephone number of the owner(s) in the designated fields. Ensure that the information is accurate.

- Provide the mailing address of the owner(s). This should include the street address, city or town, and any village information if applicable.

- Input the location of the property. Fill in the street address, city or town, any village name, and school district for the property.

- Specify the property identification details, including the tax map number or section/block/lot. These details can typically be found on the tax bill or assessment roll.

- Choose the type of energy system being applied for by selecting the appropriate checkbox for solar, wind, or farm waste energy systems. Include any necessary descriptions in the designated area.

- Write the date of completion for the energy system, ensuring you refer to the correct month and year.

- Disclose the cost of the energy system in the provided field. Attach any proof of costs if required. Additionally, specify the incremental cost, supported by relevant documentation.

- In the certification section, provide your name and sign to certify that all information provided in the application is accurate and true.

- Finalize your application by saving changes, downloading, printing, or sharing the form according to your needs.

Complete your Rp 487 form online today to secure your tax exemption benefits.

The 487 exemption in New York refers to a specific property tax exemption designed for improvements made to certain properties, often associated with renewable energy projects. This exemption can significantly reduce the tax burden on property owners for solar and other green energy installations. Utilizing resources like uslegalforms can guide you through the application process to fully leverage the benefits of the Rp 487 exemption.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.