Loading

Get Ut Urs Drwd-12 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the UT URS DRWD-12 online

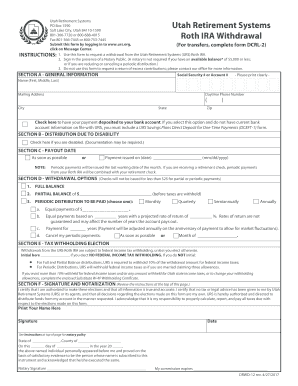

Filling out the UT URS DRWD-12 form online is an essential step for users looking to request a withdrawal from their Utah Retirement Systems Roth IRA. This guide provides a clear step-by-step process to help you navigate each section with confidence.

Follow the steps to effectively fill out the UT URS DRWD-12 form.

- Click the 'Get Form' button to access the UT URS DRWD-12 form and open it in your online editor.

- Begin with Section A - General Information. Enter your Social Security number or account number, name (first, middle, last), mailing address, and daytime phone number. Ensure that all information is printed clearly.

- In Section B - Distribution Due to Disability, check the box if you are disabled. Be prepared to provide any required documentation if necessary.

- Proceed to Section C - Payout Date. Indicate your preferred payout date by selecting 'As soon as possible' or providing a future date.

- Move to Section D - Withdrawal Options. Choose one of the options: full balance, partial balance (indicate the amount), or select a periodic distribution schedule (monthly, quarterly, semiannually, or annually). If you select equal payments based on years, specify the amount and projected rate of return.

- In Section E - Tax Withholding Election, decide on federal income tax withholding. Initial if you elect no withholding, or leave it blank if you would like the default withholding to apply.

- Finally, complete Section F - Signature and Notarization. Sign and date the form, and have it notarized if required. Make sure to review the notary requirements as outlined in the instructions.

- After you have filled out all sections, you can save changes, download, print, or share the completed UT URS DRWD-12 form.

Complete your documents online today to ensure a smooth withdrawal process.

Regardless of your age, you will need to file a Form 1040 and show the amount of the IRA withdrawal. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your Form 1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.