Loading

Get Ct603

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct603 online

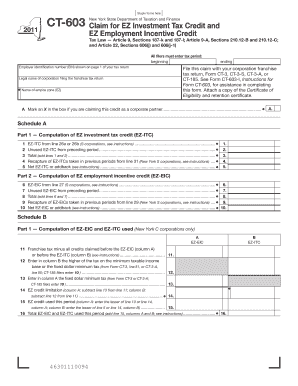

The Ct603 form is used to claim the EZ Investment Tax Credit and the EZ Employment Incentive Credit in New York. This guide will provide you with clear, step-by-step instructions to help you fill out the form accurately.

Follow the steps to complete the Ct603 form online.

- Click ‘Get Form’ button to acquire the Ct603 form and open it in your preferred viewer.

- All filers must enter the tax period information, including the beginning and ending dates for the period being reported.

- Enter your employer identification number (EIN), which can be found on page 1 of your tax return.

- Provide the legal name of the corporation that is filing the franchise tax return.

- Specify the name of the Empire Zone (EZ) associated with the credits being claimed.

- Indicate if you are claiming this credit as a corporate partner by marking an X in the appropriate box.

- Proceed to Schedule A to calculate the EZ Investment Tax Credit (EZ-ITC). Fill out each line according to the instructions provided in the form.

- Continue to Schedule B, where you will compute the credits used. Follow the instructions carefully to ensure accuracy.

- Complete Schedule C by providing detailed information about the property located in the EZ for which the EZ-ITC is claimed.

- Fill in Schedule D, addressing the eligibility for the EZ-EIC and computing the incentive credit.

- Finally, review all entries for accuracy. When you are satisfied with the completion of the form, you can either save changes, download, print, or share the form as needed.

Complete your Ct603 form online to take advantage of the available tax credits.

To file a CT tax extension online, visit the Connecticut Department of Revenue Services website and navigate to the e-filing section. Complete the required forms, including your relevant financial details, and submit them directly through the portal. This process ensures that you receive an extension without the hassle of paper forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.