Loading

Get Tx Tcdrs-85 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TCDRS-85 online

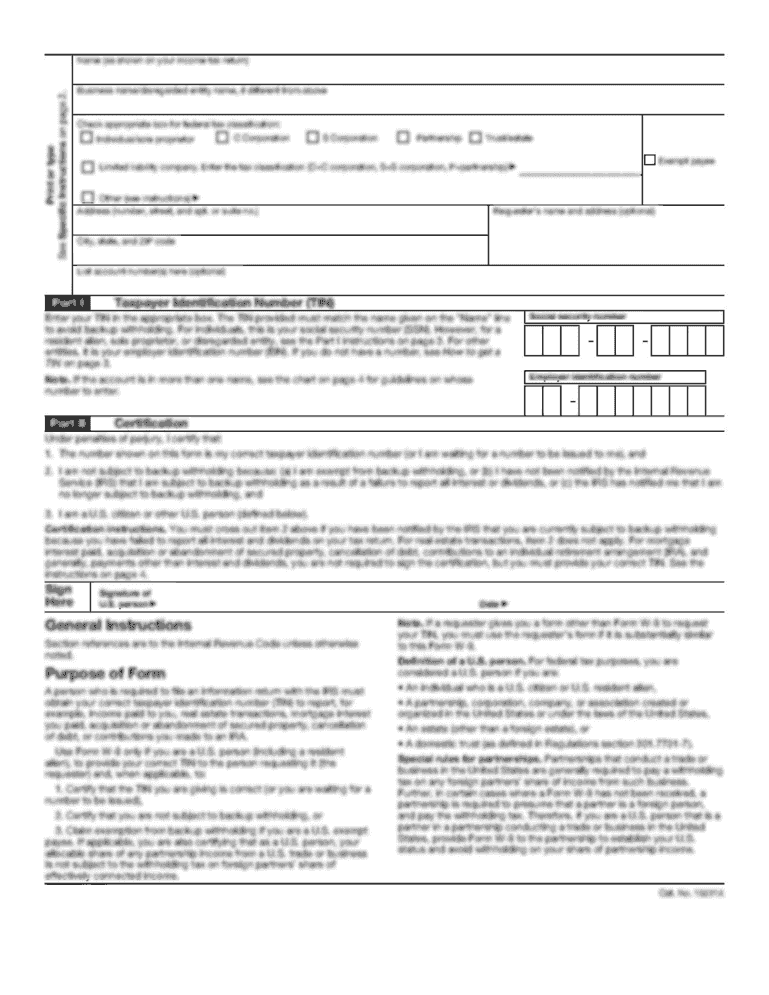

The TX TCDRS-85 form is essential for retirees looking to designate a beneficiary for their retirement benefits. This guide provides clear and supportive guidance on how to fill out the form online, ensuring that every retiree can complete the process correctly and efficiently.

Follow the steps to effectively complete the TX TCDRS-85 form.

- Press the ‘Get Form’ button to obtain the form and open it in the online document editor.

- Fill out the 'Your Information' section including your employer name, account number, Social Security number, full name, mailing address, date of birth, and phone numbers. Indicate whether you have a spouse by checking the appropriate box.

- In the beneficiary designation sections, specify your primary beneficiary or beneficiaries by providing their names, Social Security numbers, dates of birth, genders, and relationships to you. You may designate up to three primary beneficiaries.

- If applicable, specify an alternate beneficiary using the corresponding sections and ensure all required information is provided.

- If your spouse is not being designated as the primary beneficiary, fill out the Spousal Consent section, which requires the signature and full name of your spouse.

- Sign and date the form to certify that all information is accurate and complete. Make sure to initial any corrections made on the document.

- Once completed, save your changes. You can then choose to download, print, or share the form according to your needs.

Complete your TX TCDRS-85 form online to ensure your beneficiary designations are accurately recorded.

Your withdrawal will be subject to a minimum 20% withholding for taxes, you may face a 10% withdrawal penalty at tax time and your withdrawal could significantly affect your income taxes. In addition, withdrawing your TCDRS account means you lose employer matching and forfeit your lifetime benefit from that account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.