Loading

Get Ca Ftb 589 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 589 online

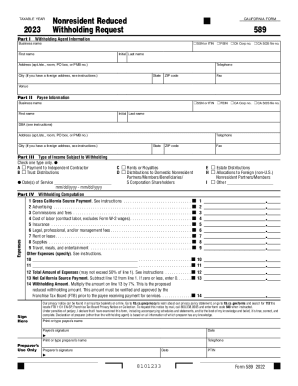

The CA FTB 589 form is essential for nonresidents seeking a reduced withholding request in California. This guide provides a step-by-step approach to complete the form accurately and efficiently in an online format.

Follow the steps to successfully complete your CA FTB 589 form.

- Press the ‘Get Form’ button to access the CA FTB 589 and open it in the provided online editor.

- In Part I, enter the withholding agent information. Provide either the Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Business Entity Identification Number (FEIN), California Corporation Number, or California Secretary of State (SOS) file number. Fill in the business name, first initial, last name, address, telephone number, city, state, and ZIP code.

- In Part II, input the payee information. Similarly, select the applicable identification number type (SSN, ITIN, FEIN, CA Corp no., CA SOS file no.). Fill in the business name, first initial, last name, if applicable, the Doing Business As (DBA) name, address, city, and state.

- Navigate to Part III to specify the type of income subject to withholding. Choose one from the options provided: payment to independent contractor, trust distributions, rents or royalties, distributions to domestic nonresident partners/members/beneficiaries/S corporation shareholders, estate distributions, allocations to foreign nonresident partners/members, or other. Provide the date(s) of service if necessary.

- Proceed to the withholding computation section where you will detail your gross California source payment and list corresponding expenses such as advertising, commissions, legal fees, and more as applicable. Ensure that the total amount of expenses does not exceed 50% of the gross payment.

- Calculate the net California source payment by subtracting total expenses from gross payments. Reflect this number in the designated field.

- Calculate the withholding amount by multiplying the net California source payment by the applicable withholding rate, noting that this amount must be approved by the Franchise Tax Board.

- Finally, sign and date the form, providing the preparer's details if applicable. Review the form for accuracy.

- Once complete, you may save changes, download the form, print it, or share it as needed.

Complete your CA FTB 589 online today to request your reduced withholding.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.