Loading

Get Met1 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Met1 2010 Form online

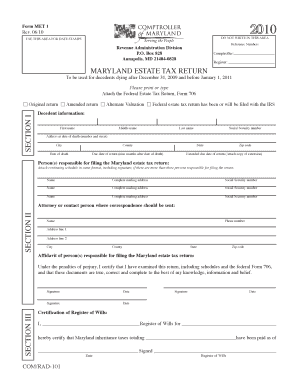

The Met1 2010 Form is essential for reporting Maryland estate taxes for decedents who died between December 31, 2009, and January 1, 2011. This guide provides clear and detailed instructions on how to complete the form online efficiently.

Follow the steps to successfully complete the Met1 2010 Form.

- Use the ‘Get Form’ button to retrieve the Met1 2010 Form and access it in your preferred editor.

- Identify whether you are filing an original return, an amended return, or electing alternate valuation in Section I. Provide the decedent's information, including their full name, Social Security number, and address at the time of death.

- List the person(s) responsible for filing the return in the designated areas of Section I. Ensure to include their names, complete mailing addresses, and Social Security numbers.

- In Section II, specify the attorney or contact person's information for future correspondence. This section should include the name, address, city, state, county, and phone number.

- Complete Section III by securing the signatures of the responsible individuals and indicating the date.

- In Section IV, proceed to compute the Maryland estate tax by filling out the necessary fields based on the values from the federal estate tax return, including any applicable schedules.

- Ensure you have included all required schedules (A, B, C, D) and the federal estate tax return (Form 706) as attachments while filing.

- Finally, once you have verified all entries for accuracy, you can save changes to the form, download it, print it, or share it as needed.

Ready to complete your filing? Get started with the Met1 2010 Form online today!

Filling out Schedule 1 of the Met1 2010 Form involves a systematic approach. Begin with clear documentation of your income sources and any deductions you wish to claim. Carefully follow the instructions laid out on the form, ensuring accuracy with numbers and details. Using platforms like USLegalForms can help guide you through this process, making it easier to navigate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.