Loading

Get La R-20212 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA R-20212 online

Filling out the LA R-20212 form can seem daunting, but this guide will walk you through the process step by step. The Louisiana Offer in Compromise Program provides users with a pathway to settle tax liabilities when full payment is not feasible.

Follow the steps to complete the LA R-20212 form online

- Click the ‘Get Form’ button to access the form and begin filling it out in the online editor.

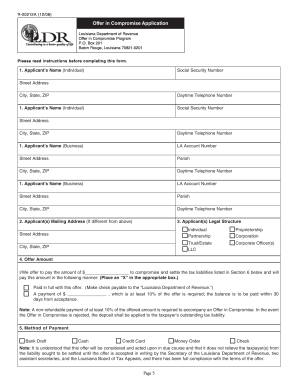

- Enter the applicant’s full name, street address, Social Security Number, Louisiana Account Number (if applicable), and daytime telephone number in Item 1.

- If the mailing address differs from the street address, provide the new mailing address in Item 2.

- In Item 3, mark an 'X' to indicate the applicant’s legal structure such as Individual, Partnership, LLC, etc.

- Enter the proposed offer amount in Item 4. Ensure a nonrefundable payment of at least 10% of this amount accompanies the offer.

- In Item 5, mark the method of payment (e.g., check, credit card, bank draft). This payment will apply toward the tax liability.

- In Item 6, specify the tax types involved, including the relevant account numbers, periods, and amounts due.

- For Item 7, indicate your reason for making the offer by marking either 'Doubt as to Collectibility' or 'Doubt as to Liability' and provide supporting documentation.

- Provide the name of the offer funding source in Item 8.

- If represented by an attorney or agent, include the completed Power of Attorney Form R-7006 as requested in Item 9.

- Read and agree to the Terms and Conditions outlined in Item 10, and have all parties involved sign and date the application.

- Finally, ensure you have completed and attached any required additional forms, save your progress, and prepare to submit the Offer in Compromise application.

Complete your LA R-20212 form online today to take the first step towards resolving your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Penalty For Failure to Pay or Underpayment of Estimated Tax Revised Statute 47:118 authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.